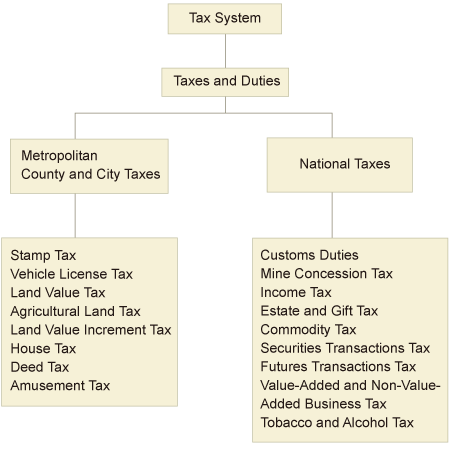

Tax System

Our country present system of taxation according to the financial revenue and expenditure allocation act, may divide into the national tax and the local tax. The national tax is belongs to the central authorities to be possible the expense tax revenue, including nine kinds: Customs duties, mine concession tax, income tax, estate and gift tax, commodity tax, securities transactions tax, futures transactions tax, value-added and non-value-added business tax, tobacco and alcohol tax. The local tax is belongs to the local authority to be possible the expense tax revenue, including the municipality and the county (city) the tax, altogether has eight kinds: Stamp tax, vehicle license tax, land value tax, land property tax, land value increment tax, house tax, deed tax, amusement tax.

Visitor:7761

Update:2023-11-22